GAME Forum

Keynote Speakers

GAME Forum

Keynote Speakers

The keynote speakers at GAME Forum are some of the world's most influential industry leaders and experts. Many firms and organizations have demonstrated their support for GAME by providing keynote speakers, panelists and workshop presenters.

2026 Speakers

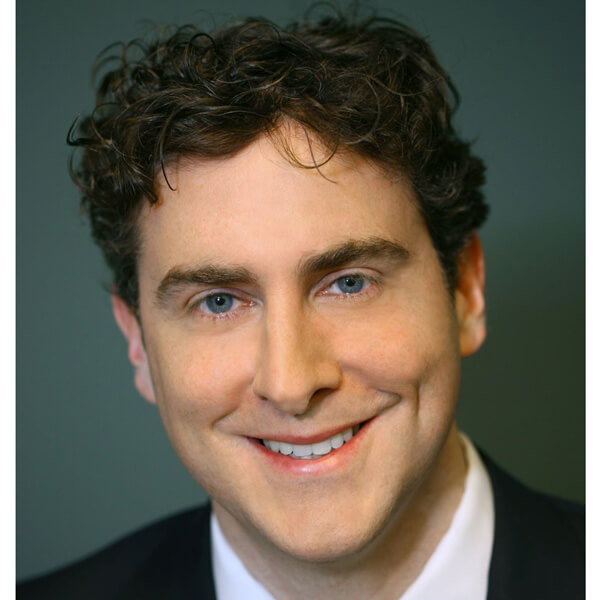

Brett M. Amendola

Managing Partner

Wooster Square Advisors

Quinnipiac University Board of Trustees Member

Brett M. Amendola has successfully leveraged his more than 30 years of experience at some of the world’s largest investment firms. He has attracted successful financial industry professionals to work side by side with some of the brightest minds graduating from colleges and universities, creating a team with extensive knowledge and experience while providing world-class financial advice and continuity of service to professionals and multi-generational business owner clients. Amendola holds the Series 6, 7, 9, 10, 24, 63, 65 and state life and health licenses and is a member of GAMA International. He has been the recipient of numerous awards and honors, including Quinnipiac University’s Outstanding Business Alumni Inaugural Recipient – 2008 and the Hartford Business Journal 40 Under 40 Award in 2008. Amendola earned a bachelor’s degree in financial management from Quinnipiac University and serves on Quinnipiac’s Board of Trustees.

Juan Carlos Artigas

Global Head of Research

World Gold Council

Juan Carlos Artigas joined the World Gold Council (WGC) in 2009. He serves as the regional CEO for the Americas and Global Head of Research and is a member of the Management Committee. He leads the strategy across the region, focusing on enhancing understanding, access and trust in gold. In addition, he and his research team develop timely insights on gold market trends, drivers of price and the role that gold plays in investment strategies.

During his tenure, Artigas has reshaped the organization’s approach to research through robust analysis, incorporating findings from gold physical and derivatives markets and their link to the macroeconomy and geopolitics. This perspective has informed the development of WGC’s Gold Valuation Framework, a novel methodology for understanding the factors that determine gold’s performance.

Previously, Artigas worked at J.P. Morgan Securities as a U.S. and Emerging Markets fixed income strategist. In this role, he developed sovereign- and corporate-debt valuation frameworks and contributed to leading U.S. and Emerging Markets financial publications.

Artigas holds a BS in actuarial sciences from ITAM (Mexico) and an MBA and MS in statistics from the University of Chicago.

Lucy Baldwin

Managing Director and Global Head of Research

Citi

Lucy Baldwin is a managing director and global head of research at Citi. Baldwin is responsible for managing Citi’s global independent research across all asset classes.

Baldwin joined Citigroup in April 2021 from Credit Suisse, where she was global head of equity sales. Prior to Credit Suisse, Baldwin was at Bank of America as head of European equity sales (2015–19), and at Goldman Sachs as a director of European equity research and in a variety of research analyst roles (2006–15). Baldwin started her career at Cazenove as an equity research analyst covering the building materials sector. Baldwin graduated from the University of Birmingham with a degree in economics.

Baldwin serves as a member of Council for the University of Birmingham and sits on the Investment Sub-Committee. Additionally, Baldwin is a member of the Advisory Council for the Mossavar-Rahmani Center for Business and Government at the Harvard Kennedy School.

Bobby Barnes

Head of Quantitative Index Solutions

Fidelity Investments

Bobby Barnes is head of the Quantitative Index Solutions (QIS) group at Fidelity Investments. Fidelity Investments is a leading provider of investment management, retirement planning, portfolio guidance, brokerage, benefits outsourcing, and other financial products and services to institutions, financial intermediaries and individuals.

QIS designs and manages proprietary indices covering equity, fixed income and multi-asset class investment vehicles. The index solutions created by the QIS group enable shareholders to gain unique market exposures via factor of thematic indices that leverage Fidelity’s proprietary investment insights.

Prior to assuming his current position, Barnes was a quantitative analyst responsible for conducting alpha research to generate stock ideas. He also advised portfolio managers on portfolio construction techniques to manage risk.

Prior to joining Fidelity as a quantitative intern in 2008, Barnes worked as a systems engineer at Freescale Semiconductor and at NASA Ames Research Center. He has been in the financial industry since joining Fidelity full time in 2009.

Barnes earned his Bachelor of Science, summa cum laude, in electrical engineering from North Carolina State University and his Master of Science, magna cum laude, in electrical engineering from Stanford University. Additionally, he earned his Master of Business Administration from Harvard Business School.

Zach Buchwald

Chairman and Chief Executive Officer

Russell Investments

Zach Buchwald is chairman and Chief Executive Officer of Russell Investments, the global investment solutions provider founded in 1936 with approximately $377 billion in assets under management. Buchwald is responsible for driving the firm’s global business strategy, fostering a culture of integrity and excellence, and championing solutions that simplify the complexities of customized, client-centric investing.

Buchwald joined Russell Investments in 2023 from BlackRock, where he served as the head of its $2 trillion Institutional Business. Throughout his nearly 15-year tenure with BlackRock, Buchwald led the company’s Financial Institutions Group and helped establish its Retirement Solutions and Financial Markets Advisory platforms. Prior to this, Buchwald served as a managing director at Morgan Stanley.

Buchwald frequently addresses the challenges of financial security and retirement. His commentary has been featured in The Washington Post, Barron’s, MarketWatch, Morningstar, Newsweek and Fortune. Buchwald is part of the CEO council for Challenge Seattle and participates in the Washington roundtable. He is a graduate of Harvard University and lives with his family in Seattle.

Kristen Castell

Managing Director

Center of Accelerating Financial Equity (CAFE)

Kristen Castell is currently the managing director for the Center for Accelerating Financial Equity (CAFE), a nonprofit that advances financial wellness for underserved communities through financial technology (FinTech) innovation and partnerships. Castell has deep experience as a product executive at large financial institutions, spending over a decade at BlackRock and years at JPMorgan building a $20 billion–plus investment platform. After growing her career as a finance executive, she became an entrepreneur, serving on the founding team as chief operating officer for Seeds, a FinTech platform for personalized, values-aligned investing.

Castell serves on many boards and in advisory roles for companies and nonprofits, including Telosa Foundation, ShareChange and the MicroDreams Foundation. She was recently named an Inspiring FinTech Female for 2023 by NYC FinTech Women for her work advocating for and connecting women FinTech founders.

Nidhi Chadda

Founder and CEO, Enzo Advisors LLC

Chief Impact Officer, Richmond Global Sciences

Nidhi Chadda is a generalist growth investor and advisor across public and private markets, with 20+ years of experience as an investment banker, strategic consultant and investor. She is the founder and CEO of Enzo Advisors, a female- and minority-led sustainability consulting practice that helps companies build sustainable business models and works with institutional investors to integrate environmental, social and governance (ESG) policies and frameworks across their investment processes.

She is also the chief impact officer for Richmond Global Sciences, where she focuses on developing and executing business strategies aligned with market and customer insights. Prior to launching Enzo Advisors, Chadda was a portfolio manager at RBC Global Asset Management. Chadda also serves on several advisory boards and investment committees.

Chadda has hosted numerous webinars and has been featured across media engagements. Chadda is also an instructor for the Southern Gas Association and spearheaded the launch of the quarterly ESG Series on behalf of the board of the Harvard Business School Women’s Association, which has hosted sold-out events since inception.

She is the recipient of the Impact Investment and Advisory Award (June 2024, NRI Achievers Awards) as well as the Outstanding Leadership in Finance Award (July 2023, MoRE 2.0 Conference).

Joyce Choi

Head of Institutional Product Strategy

BlackRock

Joyce Choi heads the institutional product strategy effort for BlackRock’s U.S. iShares fixed income ETF business — responsible for the commercialization and adoption of fixed income ETFs, innovation through new products and the expansion of the ETF ecosystem — while partnering cross-enterprise and cross-industry to unlock new areas of fixed income ETF usage across institutions.

Prior to joining BlackRock in 2017, Choi was a founding partner at London-based Vinci Zafferano Capital (VZ Capital). In this role, she was responsible for managing and trading EM rates, FX, credit and equities. Before launching VZ Capital in 2012, Choi was an investment analyst at Tudor Investment Corporation, investing in public, private and distressed credit opportunities across global emerging markets.

Choi began her career as an investment analyst at Morgan Stanley, with coverage spanning across IG and HY in the U.S. and Asian corporates in Hong Kong.

Matthew D’Alto

Director of Research

Guidepoint Global LLC

Matt D’Alto is currently Director of Research at Guidepoint Global LLC, where he leads a global equities research team utilizing an AI-enhanced, fundamental research-driven process to scale diversified industry and company-specific content creation and insights for investor and corporate clients.

D’Alto has over 30 years of experience in equities research and institutional portfolio management, including 20 years on the buy side as a senior analyst and portfolio manager across several long-only institutional money managers such as TimesSquare Capital Management, J&W Seligman and Putnam Investments. D’Alto is also currently a part-time adjunct professor of finance at Quinnipiac University.

D’Alto earned his MBA from the University of Chicago Booth School of Business and his BA from Fairfield University.

Annemarie Dalka

Investor and Private Markets Specialist

Annemarie Dalka is an investor with over 15 years of international experience in private markets. She has played a leading role in shaping the private equity ecosystem in Poland and Central and Eastern Europe, and was recognized by the Polish Private Equity and Venture Capital Association (PSIK) with the Personality of the Year award for her leadership and impact in the industry.

Throughout her career, Dalka has focused on building access to private equity, private debt and venture capital. At the Polish Development Fund (PFR), she built and managed a PLN 1.5 billion fund, investing in leading regional and international managers across these asset classes. Earlier, she worked at BNP Paribas in Investment Banking in Warsaw and London, specializing in Debt Capital Markets and commodity derivatives. Most recently, Dalka has been involved in infrastructure investments at Eneris Group, contributing to sustainable energy and circular economy initiatives.

A graduate of Kozminski University and the Stanford Graduate School of Business, she has been president of the Stanford Club of Poland since 2024.

Gaetano “Tony” DiPietro

Managing Director of Corporate Strategy and Head of Client Relations

Piedmont Fund Services

Tony DiPietro is the head of corporate strategy and client relations at Piedmont Fund Services, responsible for developing and executing strategic initiatives across the organization while optimizing operations, enhancing client services and improving financial performance.

DiPietro held several roles at BlackRock Inc. from 2003–19. He was a founding member and COO of the newly formed Fund of Hedge Fund Business (FOF) division. He provided leadership in the growth of the business which launched with $200 million in assets and grew to $3 billion across eight-plus types of products. DiPietro also developed the new client service team at BlackRock Inc., responsible for servicing the firm’s top 100 institutional clients. While developing the group, he further identified new client solutions and offered thought leadership to clients directly. Prior to joining Piedmont, DiPietro was executive director at S&P Global where he led the global customer service team for the tax solutions group within the Platforms and Regulatory Compliance (PRC) business.

DiPietro is a graduate of Quinnipiac University with a bachelor’s degree in international business. DiPietro resides in the greater Boston area with his wife and children.

Jason Draho, PhD

Head of Asset Allocation Americas

UBS Global Wealth Management

Jason Draho is a managing director and head of asset allocation Americas for UBS Global Wealth Management. He is the chair of the U.S. Investment Strategy Committee. In this capacity, Draho oversees the strategic and tactical asset allocation recommendations for approximately $1.9 trillion in invested assets. He is also responsible for the UBS House View suite of discretionary portfolios with over $32 billion in assets.

Draho leads the U.S. investment process by working with asset class, thematic, private market and ESG experts to generate recommendations for financial advisors and clients. He has also published a number of widely read reports on the U.S. economy, including a series on the “Roaring ‘20s” and the quarterly CEO Macro Briefing Book presentation.

He speaks frequently with financial advisors, clients and the media, including CNBC, Bloomberg and The WSJ, presenting UBS views and specific investment recommendations.

Prior to joining UBS, Draho spent nine years at Morgan Stanley, eventually becoming the firm’s Global Cross-Asset Strategist. He focused on global asset allocation for institutional clients, providing investment recommendations on equities, fixed income, currencies and commodities.

Draho holds a PhD in economics from Yale University and a Bachelor of Science from the University of Manitoba.

Katrina Dudley, CFA, CAIA

Senior Vice President and Investment Strategist

Franklin Templeton

Katrina Dudley, CFA, CAIA, is a senior vice president and investment strategist in the Public Market Investments group at Franklin Templeton. Prior to her current role, Dudley was a portfolio manager at Franklin Mutual Advisers.

Dudley has a passion for advocating for women in finance and business and is actively involved with Girls Who Invest. At Franklin Templeton, she is the executive co-sponsor of the Women BRG. She is the co-author of “Undiversified: The Big Gender Short in Investment Management.” Dudley is a frequent media commentator on macro- and investment-related topics and has appeared on Bloomberg Surveillance, CNBC and Fox Business.

Within her community, Dudley is vice chair of the board of The Children’s Village, a board member of the Global Association of 100 Women in Finance and a member of the Management Advisory Committee of the NYU Michael Price Student Investment Fund.

David Duong, CFA

Head of Research

Coinbase International

David Duong leads the cryptocurrency research effort for Coinbase Institutional, creating educational materials and market intelligence for the institutional investment community. His work focuses on market views, macro trends, tokenomics and systematic trading strategies for digital assets. He was previously the head of Latin America FX Research at HSBC, managing coverage on emerging markets, and has 20 years of experience working in rates, macroeconomics and quantitative modeling.

Duong has a BA in computer science and political science from Colgate University and an MSc from the London School of Economics. He is also a CFA® charterholder.

Dillon Edwards

AI Strategist and Executive Director

J.P. Morgan Asset Management

Dillon M. Edwards, executive director, is an AI strategist on the J.P. Morgan Asset Management data science team. Based in New York, Edwards focuses on working closely with data scientists and key practitioners across asset management to identify, design and deliver AI solutions that will enhance the client experience. Prior to joining J.P. Morgan, Edwards was the vice president of analytics at Bizfi, a small business lending FinTech company, where he started and grew their business intelligence group. During this time, he implemented data visualization tools throughout the firm and oversaw statistical modeling efforts to automate the underwriting process and optimize marketing campaigns. He also led the due diligence process for a Series C equity raise and $100+MM debt restructuring. Edwards holds a BS from the University of Virginia in systems engineering and economics.

Brian Gilbart

Head of Options Market Development

NYSE Group

Brian Gilbart is head of options markets development for NYSE Group, a part of Intercontinental Exchange (NYSE: ICE).

Gilbart oversees the management and development of NYSE Options business lines. He and his team are responsible for tracking transactional KPIs, performing revenue and market share modeling and optimization, and managing commercial policy and strategy for the NYSE’s two options exchanges: Arca Options and Amex Options. Gilbart’s previous roles at the NYSE include head of business analytics and director of options business development.

Prior, Gilbart was a proprietary options market maker with Belvedere Trading in Chicago. After more than a decade as a proprietary options trader, Gilbart subsequently managed all of Belvedere’s independent implied volatility and delta one prop trading groups. He started his career with UBS Securities, trading on the ETF & Program Trading desk.

Gilbart’s unique combination of front office trading and business management roles over a two-decade career give him expert credentials across the full breadth of the U.S. listed equity derivatives market.

Gilbart is a member of the STA Listed Options Committee, and an active member of the Security Traders Association of New York (STANY). He holds the Series 3, 7, 55, 56, 57 and 63 FINRA licenses.

Stacey Gilbert

Senior Director of Client Education

The Options Institute, Cboe Global Markets

After nearly three decades in listed derivatives — spanning trading, education, strategy and portfolio management — Stacey Gilbert joined The Options Institute (The OI), the educational arm of Cboe Global Markets, to share her passion for derivatives with current and future investors.

Prior to joining The OI, Gilbert spent six years at Glenmede Investment Management (GIM), where she served as GIM’s chief investment officer and co–portfolio manager of Derivatives. Before Glenmede, she built a two-decade career at Susquehanna International Group (SIG), holding multiple leadership roles. Her tenure at SIG included trading options and ETFs both on the trading desk and at the American Stock Exchange, leading SIG’s renowned Education Department and heading the sell-side Derivative Strategy Team.

Gilbert earned a Bachelor of Arts in mathematics with a minor in economics from Dartmouth College.

Przemysław Głębocki

Managing Partner and Chief Investment Officer

Accession Capital Partners

Przemysław Głębocki is the managing partner and Chief Investment Officer at Accession Capital Partners. He is also a board member of Domino’s Poland, Tatuum, WISS, SMYK, TopFarms International, Nettle and Vemo.

Głębocki has over 20 years of experience in private equity and corporate finance in Central Europe. Prior to joining ACP, Głębocki was with Ernst & Young’s Corporate Finance and Audit departments.

Głębocki holds a master’s degree in finance and banking from the Warsaw School of Economics and has pursued study programs in the U.S. and the Netherlands. He also serves as a board member of the Polish Private Equity & Venture Capital Association.

Lauren Goodwin, CFA

Chief Market Strategist

New York Life Investments

Lauren Goodwin is an economist and the chief market strategist at New York Life Investments. She leads the firm’s Global Market Strategy team and is responsible for economic and market research, asset allocation and thought leadership to empower investment decision-making.

Goodwin's research focuses on the investment implications of an evolving macroeconomic and capital markets environment. Goodwin is also a member of the Milken Institute Young Leaders Circle — a highly regarded program for select intellectually curious, motivated and philanthropic professionals. She regularly represents the firm as a keynote speaker at conferences and in television and print media outlets such as Bloomberg, CNBC, the New York Times, Nikkei and the Wall Street Journal.

Prior to joining New York Life Investments, Goodwin held economist positions at J.P. Morgan, Wells Fargo, Frontier Strategy Group and the OECD. She is a CFA® charterholder, graduated summa cum laude from the University of Southern California and holds a master’s degree in international economics from Johns Hopkins.

Larry Hamdan

Chairman of Mergers and Acquisitions, Americas

Barclays

Quinnipiac University Board of Trustees Member

Larry Hamdan is head of mergers and acquisitions for the Americas within the U.K. investment bank at Barclays. Based in New York, he is also a member of the Americas Banking Operating Committee.

Prior to joining Barclays in 2010, he worked for 21 years at Credit Suisse, where he was vice chairman of global mergers and acquisitions. He also served as the global co-head of the industrial group.

Hamdan has extensive experience advising numerous clients on more than $500 billion of transactions, including Danaher on its $21 billion acquisition of GE’s BioPharma division, US Airways on its $30 billion merger with American Airlines and TRW on its $12 billion hostile defense and sale to Northrop Grumman. Hamdan has also advised numerous clients facing demands from hedge fund activists.

He earned an AB in economics, magna cum laude, from Princeton University; a JD, magna cum laude, from Harvard Law School; and an MBA with high distinction from Harvard Business School, where he was a Baker Scholar.

Lindsay Hans

President

Merrill Wealth Management

Lindsay Hans is president and co-head of Merrill Wealth Management, and a member of Bank of America Corporation’s executive management team.

Hans, along with co-head Eric Schimpf, oversees more than 25,000 employees who provide investment and wealth management strategies to individuals and businesses across the U.S. With nearly $4 trillion in client balances as of December 31, 2025, Merrill is among the largest businesses of its kind in the world. Its financial advisors consistently rank at or near the top of various annual industry-wide rankings.

Hans and Schimpf also oversee Bank of America’s Investment Solutions Group, which includes the Chief Investment Office and a wide range of thought leadership, product, and portfolio offerings and platforms.

Previously, Hans was head of Merrill’s Private Wealth Management, International, and Institutional groups. In this role, she was responsible for delivering the business strategy, intellectual capital, resources and solutions to Merrill’s largest client relationships — domestically and internationally.

Lindsay has also served as the division executive for Merrill Wealth Management’s Northeast Division, and earlier as division executive for the Mid-Atlantic Division.

Before joining the company in 2014, Lindsay spent more than a decade at UBS, where she held several leadership positions in the wealth management business.

Marie Hardin, PhD

President

Quinnipiac University

Marie Hardin, PhD, assumed the role of president of Quinnipiac on July 1, 2025. Hardin served as dean of the Donald P. Bellisario College of Communications at Penn State from 2014–25. Under her leadership, the Bellisario College bolstered its reputation for high-quality undergraduate and graduate education, broadened its impact in interdisciplinary research and expanded its outreach.

She is an award-winning teacher and scholar with more than 60 publications in sports media, gender studies and communication. She is co-editor of two books and a book series, and co-edits the Sage journal, “Communication & Sport,” a leading title in the field. She chairs the national committee for the Accrediting Council on Education in Journalism and Mass Communication and the Hearst Foundations Journalism Awards Steering Committee. Hardin also has taught and advised students throughout her career, including as dean.

Hardin is an avid runner who has completed more than 30 marathons. She is married to Jerry Kammer, a retired Pulitzer Prize–winning reporter and Nieman Fellow at Harvard University.

Hardin earned her PhD in mass communication from the University of Georgia, an MA in communication from Georgia State University, and a BA in theology from Ambassador University in Pasadena, California.

Kristina Hooper

Chief Market Strategist

Man Group

Kristina Hooper is the chief market strategist at Man Group, a global alternative investment manager. In this role, she provides views and insights on the economy and markets. She was featured on the cover of the January 2015 issue of Kiplinger’s magazine and appears regularly on CNBC, Bloomberg TV and Yahoo Finance. She has also been a mainstage speaker at numerous national and regional conferences. She is regularly quoted in The Wall Street Journal, Financial Times, The New York Times, Reuters and other financial news publications.

Prior to joining Man Group in 2025, Hooper served as the chief global market strategist at Invesco and worked at Allianz Global Investors as U.S. investment strategist.

She earned a BA, cum laude, from Wellesley College; a JD from Pace University School of Law, where she was a Trustees’ Merit Scholar; an MBA in finance from New York University Stern School of Business, where she was a teaching fellow in macroeconomics and organisational behaviour; and a master’s degree from the Cornell University School of Industrial and Labor Relations, where she focused on labour economics.

Kathy Jones

Managing Director and Chief Fixed Income Strategist

Schwab Center for Financial Research

Kathy Jones is responsible for interest rate and currency analysis and fixed income education for Schwab clients and the public. She also co-hosts Schwab's On Investing podcast.

Prior to joining Schwab in 2011, Jones was a fixed income strategist at Morgan Stanley, where she specialized in global macro strategy covering domestic and international bonds and foreign exchange. She has also been a consultant in the alternative investment area and previously served as executive vice president of the Debt Capital Markets division of Prudential Securities.

Jones has analyzed global bonds, foreign currency and commodity markets extensively throughout her career as an investment analyst and strategist, working with both institutional and retail clients. She makes regular broadcast appearances on Bloomberg TV, Yahoo Finance and CNBC and is often quoted by The Wall Street Journal, The New York Times, The Financial Times and Reuters. She holds an MBA in finance from the Kellogg Graduate School of Management at Northwestern University and a BA with honors in English literature from Northwestern University.

Jitania Kandhari

Deputy CIO of the Solutions and Multi-Asset Group

Morgan Stanley

Jitania Kandhari is the deputy CIO of the Solutions and Multi-Asset Group, co-lead portfolio manager for the Active International Allocation Strategy, and head of macro and thematic research for the Emerging Markets Equity team at Morgan Stanley.

She joined Morgan Stanley in 2006 and has 24 years of investment experience in global macroeconomics, country and market analytics, currencies and thematic investments. Kandhari was named in Citywire’s Top 20 Female Portfolio Managers in the U.S. for 2021.

Prior to joining the firm, Kandhari was an associate vice president in private banking at ABN AMRO (Royal Bank of Scotland). Kandhari began her career in India at First Global Securities in Indian equities. She holds a Bachelor of Commerce in advanced financial and management accounting and an MMS in finance, both from the University of Mumbai.

Tom Keene, CFA

Bloomberg Surveillance on YouTube, Bloomberg Podcasts & Radio

Worldwide

Tom Keene is the host of “Surveillance” on Bloomberg Radio, airing weekdays from 7–10 a.m. ET. In addition to his work on “Bloomberg Surveillance,” Keene provides economic and investment perspective to Bloomberg’s various news divisions. Keene also founded the “Chart of the Day” article, available on the Bloomberg Professional Service. Keene is editor of “Flying on One Engine: The Bloomberg Book of Master Market Economists,” published in 2005. (Two chapters appeared in the CFA Institute curriculum.) A graduate of the Rochester Institute of Technology, Keene is a Chartered Financial Analyst® and a member of the CFA Institute, National Association for Business Economics, the American Economic Association and the Economic Club of New York.

David Kelly, CFA, PhD

Chief Global Strategist

J.P. Morgan Asset Management

David Kelly, CFA, is chief global strategist and head of the Global Market Insights Strategy team for J.P. Morgan Asset Management. With more than 20 years of experience, Kelly provides valuable insight and perspective on the economy and markets to thousands of financial advisors and their clients.

Throughout his career, Kelly has developed a unique ability to explain complex economic and market issues in a language that financial advisors can use to communicate with their clients. He is a keynote speaker at many national investment conferences and a frequent guest on CNBC and other financial news outlets.

Before joining J.P. Morgan Asset Management, he was an economic advisor to Putnam Investments. He also has served as a senior strategist/economist at SPP Investment Management, Primark Decision Economics, Lehman Brothers and DRI/McGraw-Hill.

Kelly is a CFA® charterholder. He has an MA and PhD in economics from Michigan State University and a BA in economics from University College Dublin in Ireland.

Nirbhay Kumar

Founder

Pinnacle Paths

As a respected executive and strategic advisor within the Capital Markets and FinTech ecosystem, Nirbhay Kumar brings over 25 years of experience and a leverageable network of decision makers, founders, innovators, and venture capitalists. His cross-functional network within investment management, alternatives, custody banking, wealth management, digital assets and FinTech is widely recognized by leaders across this ecosystem.

Kumar has combined this knowledge with his network into a bespoke, confidential, curated and highly effective professional branding, networking and job search service for experienced professionals. Currently, his clients include seasoned professionals with diverse functional capabilities whose former or current employers span the gamut of blue-chip asset managers, banks, consulting firms and FinTechs.

Kumar also works with students (international and local) at Columbia, Yale, UPenn, Brown, Wesleyan, UT Austin, University of Wisconsin, Emory, Purdue, Indiana University and others. His proprietary Career Development framework informs students about the many opportunities across banking, investment management, FinTech and consulting; helps them build their own professional brands and networks; and connects them with senior leaders in these sectors. This framework has resulted in students getting internships (even as first-years and sophomores) at a variety of firms across blockchain, digital assets, venture capital, investment banking, FinTech and investment management.

Kumar has an MBA from the Stern School of Business at New York University, and a BBA from Bryant University.

Julia La Roche

Founder and Host

The Julia La Roche Show

Julia La Roche is the founder and host of The Julia La Roche Show, featuring in-depth conversations with prominent investors and business leaders. A veteran financial journalist, she has built her career covering markets, finance, and the people shaping the investment landscape. La Roche previously served as a correspondent at Yahoo Finance, where she reported on breaking financial news and conducted interviews with some of the industry's most influential figures. Before that, she worked at Business Insider and CNBC.com. She is a graduate of the University of North Carolina at Chapel Hill.

Debra Liebowitz, PhD

Provost

Quinnipiac University

Debra Liebowitz is an innovative leader with an impactful record of creating partnerships and launching initiatives that enable university growth, promote diversity, strengthen shared governance and foster immersive learning opportunities. She oversees all academic programs at Quinnipiac, the university’s eight schools and the College of Arts & Sciences and all other academic units and centers. She is also a professor of political science at Quinnipiac.

Since joining Quinnipiac in 2020, Liebowitz has played a key role in earning Board of Trustees support for unprecedented investments in academic facilities and faculty hiring at the university. These initiatives include a new School of Business, an innovation, science and technology building, and a strategic faculty hiring initiative to build distinctive academic offerings, promote interdisciplinary collaborations, and advance the recruitment, retention and success of underrepresented faculty and students.

Matthew Luzzetti

Chief U.S. Economist and Head of U.S. Economic Research

Deutsche Bank

Matthew Luzzetti is chief U.S. economist and head of U.S. economic research at Deutsche Bank in New York. He was previously an economist in DB’s Office of the Chief Economist in London. In 2017, Luzzetti was named to Business Insider’s Rising Stars on Wall Street Under 35. His research has appeared in several books on economic policy and in refereed macroeconomics journals.

Luzzetti holds a PhD in economics from the University of California, Los Angeles. While at UCLA, he worked at the U.S. Department of the Treasury in the Office of Financial Research. Prior to graduate school, he spent two years as a research analyst in the macroeconomics department at the Federal Reserve Bank of Philadelphia.

Samantha Merwin, CFA

U.S. Head of Market Development

BlackRock

Samantha Merwin, CFA, is a managing director and the U.S. head of market development at BlackRock, where she helps shape the evolution of markets to support investor access and product innovation.

Merwin works with stakeholders in and around the capital markets ecosystem, including academics, market makers, trading venues and service providers, to protect and advance market functioning and deliver more investments to more people.

Previously, Merwin was the head of advocacy for BlackRock Global Markets & Investments and the head of markets advocacy for ETFs & Index Investing at BlackRock. She has also held roles in BlackRock’s Strategic Partner Program team and BlackRock’s Portfolio Compliance Group, where she started her career as an analyst in 2012.

She earned a BS in International Business with dual concentrations in finance and Spanish from Bryant University.

Merwin is passionate about helping more women explore careers in finance and serves on the Bryant University Wall Street Council and the advisory board for the Center for Women in Finance and Leadership. She is also a CFA® charterholder.

Christiana Michael ’13

VP, Institutional Credit Sales

HSBC

Christiana Michael joined HSBC in September 2021 on the Institutional Credit Sales desk. In this role, she continues to leverage her wide network of relationships in the credit business.

Prior to joining HSBC, Michael spent just under seven years at Seaport Global, working on both the Investment Grade and High Yield Credit desks. She gained a deep knowledge of the credit markets and formed close relationships with institutional clients.

Michael graduated from Quinnipiac University with a bachelor’s degree in finance. During her time at Quinnipiac, she completed an internship with Morgan Stanley in structured products before becoming a full-time analyst in fixed income.

Leszek Muzyczyszyn

Senior Partner

Innova Capital

Leszek Muzyczyszyn brings 29 years of experience in private equity, with 18 years at Innova Capital. Since joining Innova in 2007, Muzyczyszyn’s chief responsibilities have included leading the portfolio function, which oversees the value creation and development process for Innova’s investments. He also chairs the firm’s Portfolio Committee.

Prior to joining Innova, Muzyczyszyn spent three years as director of Darby Private Equity, overseeing mezzanine financings and private equity investments across multiple sectors and countries in C&EE region. Before Darby, he spent over eight years in total with Allianz Specialized Investments in London and Warsaw.

Muzyczyszyn holds an AMP from Harvard Business School, an MBA from Bayes Business School and an MA (Distinction) in law from the University of Warsaw. Muzyczyszyn served as President of the Polish Private Equity and Venture Capital Association from 2018–21.

Michael Nadeau

Founder

The DeFi Report

Michael Nadeau is the founder of The DeFi Report, a leading crypto research and advisory firm focused on onchain data, digital asset fundamentals and the intersection of macroeconomics and blockchain networks. His work bridges traditional finance and decentralized finance, offering data-driven insights that help investors understand the evolving structure of the crypto economy.

Prior to founding The DeFi Report, Nadeau spent over 10 years in finance and accounting, most recently at MIT Investment Management Company.

Adam Niewinski

Co-Founder and Managing Partner

OTB Ventures

Adam Niewinski has over 20 years of experience as an entrepreneur and senior executive and has been an investor for over a decade. He has co-founded several companies, including Expander (acquired by GE Capital/Aviva) and Platinum Bank (investors included Goldman Sachs, Warburg Pincus). Previously, Niewinski spent 16 years at UniCredit Group, most recently as deputy CEO of Bank PEKAO SA (WSE:PEO).

In 2017 he co-founded OTB Ventures, taking on the role of managing partner. OTB Ventures stands out as a prominent European VC focused on DeepTech startups with a total of over $350 million under management. Fund expertise lies in investing in early-stage, high-growth startups that develop unique technologies in four verticals: SpaceTech, AI & Automation, FinTech and Cybersecurity.

Peter Oades

Senior Vice President and Chief Investment Officer

Aetna, Inc.

Peter Oades oversees and directs Aetna’s over $34 billion diversified investment portfolio as well as the $5.4 billion pension assets. Oades also manages Aetna’s large case pension and long-term care operations.

Prior to his appointment as chief investment officer, Oades directed the fixed income portfolio management group of Aetna since February 2008. He was responsible for Aetna’s $20 billion fixed income group, overseeing the portfolio management of both short-term and long-term fixed income investments. Previously, Oades was the senior portfolio manager responsible for managing Aetna’s emerging market bond portfolio. Oades has been responsible for managing asset-backed, investment-grade corporate and high-yield bond portfolios. He joined Aetna as an associate actuary in the investment risk management group, later moving into portfolio management. Before his career at Aetna, Oades worked in various actuarial positions at both The Travelers and The Hartford.

Matt Orsagh

Co-Founder

Arketa Institute

Matt Orsagh is a co-founder of Arketa Institute for Post-Growth Finance. Arketa Institute seeks to normalize the concepts of Ecological Economics and Degrowth in the worlds of economics and finance in order for humanity to live within planetary boundaries. Orsagh is a sustainability thought leader with over 25 years of experience in the financial industry. He has written extensively on the issues of sustainability and a post-growth economy. You can read his blog, "Degrowth is the Answer," and find him as a guest on numerous podcasts discussing economics, sustainability and what a post-growth economy would look like. He has a Master of Business Administration in finance from Georgia State University and an undergraduate degree from the University of Notre Dame.

Josh Pearl

Founder and Chief Investment Officer

Hickory Lane Capital Management

Josh Pearl is the founder and Chief Investment Officer of Hickory Lane Capital Management LP. He focuses on fundamental-based investments and special situations, primarily within the TMT, industrials and infrastructure sectors.

From 2011–20, he served as a managing director and partner at Brahman Capital, an equity long/short manager. Previously, he structured high-yield financings, leveraged buyouts and restructurings as a director at UBS Investment Bank.

Pearl earned his BS in business from Indiana University's Kelley School of Business in 2003. He is the co-author of Investment Banking: Valuation, LBOs, M&A, and IPOs and The Little Book of Investing Like the Pros. Pearl grew up in Cleveland, Ohio, and currently resides in New York with his family.

Chris Perkins

Managing Partner and President

CoinFund

Chris Perkins serves as managing partner and president of CoinFund, driving day-to-day excellence and enterprise scale by bridging the gap between cryptocurrency native investing and traditional finance. He also advocates for the interests of the crypto ecosystem through his appointment to the CFTC (Commodity Futures Trading Commission)’s Global Markets Advisory Committee and its Digital Asset Markets Subcommittee. He has testified before Congress on crypto market structure design.

Perkins is the co-inventor of the Composite Ether Staking Rate (CESR), which is the first interest rate benchmark of its kind in the crypto industry.

Prior to joining CoinFund, Perkins served as global co-head of Futures, Clearing and Foreign Exchange Prime Brokerage (FXPB) businesses at Citi. He was responsible for delivering leading listed derivative electronic and voice execution, comprehensive central clearing and No. 1–ranked OTC Clearing and FXPB services.

Prior to joining Citi in 2008, Perkins served as U.S. Head of Derivatives Intermediation at Lehman Brothers. An Iraq war veteran, Perkins served in the U.S. Marine Corps for nine years, achieving the rank of Captain. Perkins is the co-founder of Veterans in Digital Assets (VIDA) and Veterans on Wall Street (VOWS), international initiatives focused on veterans’ employment and empowerment. He is a member of the Economic Club of New York.

Dana M. Peterson

Chief Economist and Leader of the Economy, Strategy and Finance Center

The Conference Board

Dana M. Peterson is the chief economist and leader of the Economy, Strategy and Finance Center at The Conference Board. Prior to this, she served as a North America economist and later as a global economist at Citi, the world’s largest investment bank. Her wealth of experience extends to the public sector, having also worked at the Federal Reserve Board in Washington, D.C.

Peterson’s wide-ranging economics portfolio includes analyzing global themes having direct financial market implications, including monetary policy, inflation, labor markets, fiscal and trade policy, debt, taxation, ESG, consumption and demographics. Her work also examines myriad U.S. themes leveraging granular data.

Peterson’s research has been featured by U.S. and international news outlets, both in print and broadcast. Publications and networks include CNBC, FOX Business, Bloomberg, Thomson Reuters, CNN Finance, Yahoo Finance, TD Ameritrade, Barron’s, The Financial Times and The Wall Street Journal. She is a member of the Board of Directors of NBER, NABE and the Global Interdependence Center; the 1st Vice Chair of the New York Association for Business Economics (NYABE); and a member of NBEIC, the Forecasters Club and the Council on Foreign Relations.

Holly Raider, PhD

Dean

Quinnipiac University School of Business

Holly J. Raider, PhD, is a transformational academic leader experienced in driving institutional growth, financial sustainability, student success, and academic distinction across global universities. Dean Raider has led the Quinnipiac School of Business in opening a state-of-the-art building fully equipped with industry-leading technology, launching executive education and innovative programs such as Financial Technology (FinTech) and Sport & Entertainment Management, and spearheading the school’s capital campaign. She serves on the executive committee of the partnership between Quinnipiac and Hartford HealthCare. Dean Raider co-chairs the AACSB Business Influencer Council.

An award-winning educator, Dean Raider has advanced the access, quality and impact of business education in a career spanning several distinguished business schools, including the Kellogg School of Management at Northwestern University, the Booth School of Business at the University of Chicago and INSEAD in France.

Dean Raider is an expert in strategy, leadership change, business transitions and stakeholder engagement in high-stakes, turn-around situations. Dean Raider’s article “How to Strengthen Your Network When You’re Just Starting Out” was featured in Harvard Business Review’s special issue on the New Rules of Networking. Dean Raider was honored with a teaching award from Northwestern’s Business Institutions program and a Northwestern Wildcat Excellence Award.

Katherine Santiago, CFA

Managing Director

J.P. Morgan Asset Management

Katherine S. Santiago, managing director, is the head of quantitative research in the Multi-Asset Solutions team, responsible for the quantitative models that help establish the broad asset allocation reflected across the Multi-Asset Solutions team’s portfolios globally. Currently based in New York and an employee since 2005, she is also a portfolio manager focusing on retirement drawdown strategies and tactical asset allocation across multi-asset portfolios. Previously, Santiago has worked in both New York and London as part of the research team and focused on developing inflation, retirement and alternative beta products. Santiago holds a BA in mathematics from Bowdoin College, an MS in mathematics in finance from New York University, and is a CFA® charterholder.

Iro Tasitsiomi, PhD

Head of AI and Data Science

T. Rowe Price

Dr. Iro Tasitsiomi is the head of AI and data science at T. Rowe Price, where she’s been instrumental in creating and integrating innovative investment signals with the firm’s fundamental investing approaches. She also oversees the company’s new AI labs and is responsible for formulating the strategy to adopt AI across the whole firm.

Tasitsiomi held significant roles at Forbes 500 companies such as Prudential Asset Management, Goldman Sachs and BlackRock. She started her finance career in quantitative finance, leading teams that developed investment/trading/risk management strategies.

Tasitsiomi has been a featured speaker at the Open Data Science Conference, Data Science Salon, The AI Summit, The Summit for Asset Management, the Financial Information Summit, Global CIO Institute, the AI and Finance Lecture Series and Quant Strats. She has been interviewed by The Economist, CIOReview magazine, the Chicago Sun-Times and the Chicago Chronicle.

She holds a PhD in astrophysics and an MS in physics from the University of Chicago, has served as a professor at Princeton University and is a well-published research author.

Justin Thomson

Head of Investment Institute and Chief Investment Officer

T. Rowe Price

Justin Thomson is head of the T. Rowe Price Investment Institute and chief investment officer. He is a vice president of T. Rowe Price Group Inc. and T. Rowe Price International Ltd. and is based in London.

Thomson’s investment experience began in 1991. He has been with T. Rowe Price since 1998, beginning in the International Equity Division. From 1998 to 2020, he was the lead portfolio manager for the firm’s International Small-Cap Strategy. In 2007, he incepted the European Small-Cap Strategy and managed that until 2016. From 2021–24, he served as head of T. Rowe Price’s International Equity Division. Prior to this, Thomson was employed by GT Capital/LGT/Invesco, where he was a portfolio manager.

Thomson earned an MA in economics from Cambridge University.

Blerina Uruçi

Chief U.S. Economist

T. Rowe Price Fixed Income Division

Blerina Uruçi is a U.S. economist in the fixed income division at T. Rowe Price. She contributes to the formulation of investment strategy and supports investment and client development activities throughout the firm, specifically focusing on the outlook for the U.S. economy, inflation and monetary policy.

Uruçi’s investment experience began in 2007. Before joining T. Rowe Price in 2022, Uruçi was a senior U.S. economist in the Washington, D.C., office of Barclays Capital. Previously, she was a European economist with Barclays’ London office, where she was accountable for the U.K. market.

Uruçi earned a BSc with first-class honors in economics and politics from the University of Bath in Bath, England, and an MSc in economics from the London School of Economics and Political Science.

Elaine Villas-Obusan

Strategic Global Marketing Leader

Elaine Villas-Obusan is a seasoned global marketing leader responsible for creating and developing a unified marketing strategy for financial services firms, deploying client and product marketing, digital and marketing communications. She has also partnered closely with the C-suite, Distribution, Investment teams, and other key stakeholders across the firm to create a holistic, outcome-focused experience for clients.

Villas-Obusan has more than 20 years of global asset management experience. Most recently, she was SVP, head of retail marketing at Amundi US, responsible for driving the retail marketing activities in the Americas and for the U.S. retail export business in Europe and Asia. She oversaw the development of comprehensive marketing material for all investment products and promotional campaigns, enhancing the brand, positioning strategic themes and investment strategies. Through marketing automation, she has made continuous improvements across all aspects of marketing to ensure an elevated level of efficiency and effectiveness.

Prior to Amundi US, Villas-Obusan was marketing consultant at Wells Fargo Asset Management (WFAM), where she was responsible for leading and implementing the marketing strategy behind the launch of the firm’s proprietary customized Separately Managed Account platform (SMA). Prior to WFAM, Villas-Obusan was a Director and Head of Investments and Intermediary Marketing at Foresters Financial, where she led the product marketing team responsible for developing and implementing the firm’s digital first go-to-market strategy including management of the firm’s content. Previously, she held a variety of senior product marketing roles at leading asset management firms including Aberdeen Asset Management where she was Head of Intermediary Marketing. She also worked at Four Wood Capital Partners, as Director of Strategic Marketing and Vice President of Marketing for the Transparent Value Equity strategies at Guggenheim Partners. She started her career at OppenheimerFunds working across integrated marketing, digital marketing, brand and product marketing.

Villas-Obusan has a Bachelor of Business in marketing with a minor in land economy from Western Sydney University, Hawkesbury, Sydney, Australia and holds a FINRA Series 6 license.